Sales sells, but who’s buying?

Originally published in Product Marketing Alliance on Feb 29, 2024. Estimated reading time: 7 minutes.

The struggle to sell to an enterprise evolves every year with newer wrinkles.

To help you empathize with the chaotic nature of B2B enterprise selling, let’s look at a cross-section of 3 issues below, and hopefully, at least one resonates with you.

We’re seeing longer sales cycles with more people in the mix.

You have to graduate from selling point solutions to making the platform sale at some point in your enterprise software journey. This sale becomes harder and harder as companies squeeze their budgets. You have to worry about not only the traditional user and buyer but also a whole set of new groups.

Don’t want to take my word for it? Gartner estimates that 6 to 10 people, on average, are part of a purchase decision in most B2B enterprises.

You also notice many non-traditional buying centers - I’m referring to a function or department that holds the budget when I say buying center here. Sales folks are unsure how to speak to every one of them. These buying centers sometimes have conflicting objectives. But your product still needs to be relevant to them somehow.

It’s easy to win small deals, but bigger deals are hard to come by.

Different people or teams own fractions of the budget you’re after—another reason for enterprise tool sprawl. You’ve only truly won over the teams in a company if you get them to standardize on your product.

Additionally, you tend to leave money on the table - both in terms of opportunity and share of wallet - especially if your category is historically under-monetized. A good example comes from the world of developer tools. According to Battery Ventures, the budgets for developer tools fall in the $1-5MM range on average. It is the average because not all companies prioritize investments in developer tools. If you’re a developer tool company, you’re at the mercy of the maturity of your customer.

The step-level changes in spending automatically bring in more scrutiny, too. If you want to graduate from $100K to $500K to $1MM in ARR from an account, the journey depends on how comfortable you are working with so many talking heads in the same room/meeting. Graduating from one level to another immediately triggers additional checks, sign-offs, and purchase policies.

Sales reps (sometimes) struggle to convey product value.

A great way to check if your sales enablement efforts hold any weight is to offer the ‘day in the life’ test to every sales rep within the company. Ask them if they can describe a single day in the life of each of the key personas you lose sleep over. If they’re unable to, you know you have a lot of work left to do.

You want your sales reps to be prudent enough to narrow down to the use cases that matter based on the prospect in front of them. Ideally, you don’t want salespeople to try to boil the entire ocean by discussing every use case in your product.

Finally, can your sales reps share assets and talk in a way that moves the prospect closer to a decision? All they need to do is create a spark. An interest. Or the initial wedge that forces the prospect to want to explore more.

I want to offer a 2-step playbook to tackle all the above prickly issues.

STEP 1: Start mapping your buying centers

One must appeal to multiple departments with sometimes conflicting interests. Try this mapping exercise if you’re new to the idea of buying centers.

Which buying centers do I usually speak to or bump into?

Which new buying centers do I see pop up in my deals?

Can I categorize them in some way - for ex: by role?

How do these buying centers connect to each other in a sale?

What are (if any) conflicting interests between these buying centers?

You may recognize this mapping exercise as a variation of stakeholder mapping from your MBA classes.

Who do you lean on to answer these questions?

Start with the teams that interact with prospects and customers day in and day out. Sales, Customer Success, Solution Architects, Professional Services, and Support teams are safe bets. As always, do your own research too! Explore 3rd party research sources, editorials in your space, competitors, and, more importantly, your in-house customer research or product insights team.

STEP 2: Create a cheat sheet per buying center

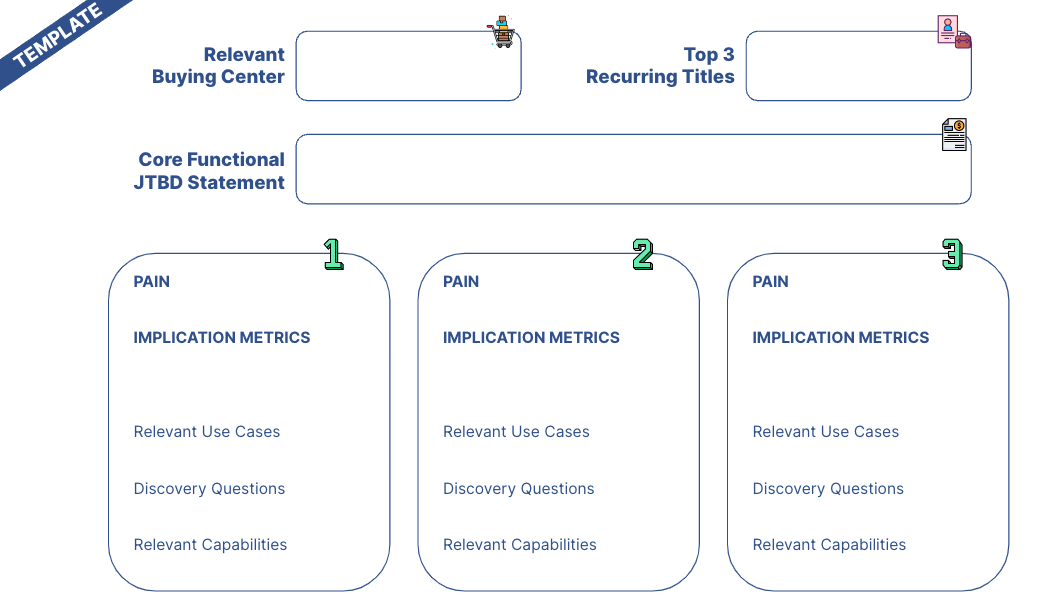

Buying Center Cheat Sheet Template - Source: Bryan Elanko

Once you’re done mapping the buying centers, use the template above to create a cheat sheet for each buying center. Let’s say you uncover 7 buying centers from the mapping exercise; proceed to create a cheat sheet for each of those 7 buying centers.

Let me walk you through the sections on the template using an example.

Relevant Buying Center

To reiterate, a buying center is a function/department that holds the budget. Depending on your enterprise product, ‘Security’ can be a buying center, and we’ll use that as an example.

Top 3 Recurring Titles

Identify the common personas within the buying center across levels here. Rely on past sales interactions to fill this out. Otherwise, you do your research to fill this in. It’s also possible that not all titles within a certain buying center are the personas you care about.

In the case of the Security buying center, the personas can be CISO, VP of Security Engineering & Development, and Global Security Architect.

Core Functional JTBD Statement

Create a product and service agnostic statement using the Jobs to be Done (JTBD) mindset for your buying center. This statement should effectively describe what the buying center is trying to achieve or accomplish in a given situation.

Sample JTBD statement for the Security buying center - “Develop, implement, enforce enterprise-wide security, governance, resiliency policies to enable and advance business objectives.”

Pains

Compile all the pains preventing the buying center from getting its job done, i.e., preventing them from executing them on the JTBD statement. Prioritize them. Use the prioritized list to pick the top 3 pains you can address. Again, compile pains, prioritize pains, and select the top 3 from the list you can address well.

Implication Metrics

Identify the top 3 to 5 metrics you can link to the pain. Said differently, what are a few metrics that get hurt due to the existence of the pain? Specifically, choose the metrics your prospect directly or indirectly owns. You want to show how your product moves the metrics in favor of your prospect.

Examples of implication metrics for the Security buying center, depending on the pain, can be breach lifecycle, data breach costs, downtime of critical applications, to list a few.

Relevant Use Cases

List the specific use cases from modules under your platform that resolve the pains. There are different definitions for use cases out there. Strictly think in terms of how the user is using your product to get to a specific goal.

Discovery Questions

Ask yourself the top 3 potential questions that can come in handy for your sales rep to surface each pain in question.

Here are a few essential pointers on how you can think about structuring these questions.

Ask assumption-busting questions. Try building questions around your assumptions about the prospect's pain, the job they're trying to do, the hurdles they encounter, etc. Assumption-busting questions force you to validate/invalidate your positioning of the product, uncover better areas for your product to focus on, prioritize specific messages over others, and much more.

Switch between conversational lenses for more productive questions. A couple of lenses worth a try to give you some initial ideas -

A day in the life lens - ex: What are your typical day-to-day interactions? Who do you work with? Which metrics do you send to your boss?

The ideal world lens - ex: What would happen in your ideal world? What would the perfect process look like? What's the gap vs. now?

The success lens - ex: When do you know you're successful? What are the benefits of removing the impediments to success?

Relevant Capabilities

Highlight the modules under your platform linked to the use cases.

How does every Product Marketing team benefit from this?

Enterprise-Wide Selling

You think bigger than personas and unravel the whole landscape, forming the crux of enterprise-wide selling. You identify missing pieces while making your case for the complex and elaborate sale.

Discovery Process

You pay attention not only to the users but also to decision-makers. You consider ratifiers, champions, and influencers.

Competitive Positioning

You own the mind faster and proactively better than the competition.

Content Strategy

Prioritize your content. Customize it to speak to the interests of the buying center. Does it move the person I’m talking to closer to a decision?

Sales Strategy & Feedback

You reduce the onboarding time for new sales folks and improve the effectiveness of existing ones. Furthermore, you can create a feedback loop for your team to understand what resonates or doesn’t in the field. Also, rely on sales feedback for updates to cheat sheets and to uncover new buying centers.

Check out the presentation on this topic from the PMA Chicago 2023 event.

Subscribe to my free 2-min PMM newsletter - Join a growing community of strategists and product marketers. On every issue, you get 📈 4 micro case studies 📚 1 book & top 3 insights 🧠 5 curated marketing think pieces.